- Pharmaceutical Technology-12-02-2017

- Volume 41

- Issue 12

What are the Ingredients for Bio/Pharma Career Advancement?

Amid business and regulatory uncertainty, bio/pharma experts reveal opinions on salary, recognition, and training.

Editor’s Note: This article was published in Pharmaceutical Technology Europe.

An efficient, effective drug development and manufacturing operation is crafted by talented, experienced pharmaceutical scientists and engineers. Synthesizing the recipe for success can be daunting, especially in the current uncertain business and regulatory environment.

More complex molecules demand more sophisticated formulation methods. Advanced technology for pharmaceutical manufacturing will increase the required skill sets of bio/pharma workers. The industry also faces gaps in know-how and expertise as experienced employees retire.

These factors suggest a challenge for bio/pharma employers and a positive employment picture for bio/pharma employees seeking to start or advance careers in the bio/pharmaceutical industry. Mix in financial pressures from shareholders and payers, pressure to reduce costs, and business and regulatory uncertainties related to Brexit, however, and the final result may be conflicts between employer priorities and employee career paths.

Respondents to Pharmaceutical Technology/Pharmaceutical Technology Europe’s annual employment survey (1) shared opinions about the current employment environment, expressed reservations about compensation and workloads, and indicated that better career opportunities were a top priority. While respondents based in Europe generally agreed with their counterparts in the United States and around the world, there were some significant differences.

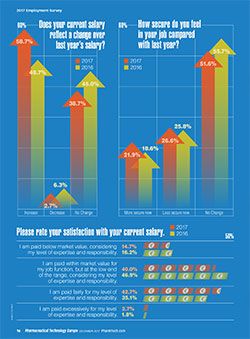

More than 45% of the Europe-based respondents reported that business increased in 2017 compared to 2016. Respondents felt “more secure” in their positions in 2017 (21.9%) versus 18.6% in 2016 (2); however, more respondents said they felt less secure in 2017 (26.6%) compared with 25.8% in 2016 (

).

Opinions about the job market varied. Nearly one-half of the Europe-based respondents said the job market was moderately competitive, compared with 44.3% for the global audience. Alternately, 21.6% of the Europe-based audience (25% for global audience) said the market for jobs was competitive; there are more qualified candidates than open jobs. The remaining 30% said there are few qualified applicants for open positions and employers must compete for qualified candidates.

Survey respondent profile

More than 480 bio/pharma professionals from around the globe--nearly 20% from Europe--responded to the survey, which was fielded in September and October 2017. Respondents primarily were full-time, permanent employees (87.3% of respondents) at innovator bio/pharmaceutical companies (33.8%), generic-drug manufacturing companies (11.6%), contract research and manufacturing organizations (15.8%), and consulting firms (6.4%).

The represented companies develop or manufacture both small- and large-molecule drugs, vaccines, and cell therapy or regenerative medicines for privately held companies (40.4%), publicly traded companies (40.2%), and non-profit/academic/government groups (14.2%).

Respondents reported a range of job responsibilities, from R&D, to manufacturing, to quality control/assurance. Similar to the global responses, more than 47% of the Europe-based responses work for companies with more than 5000 employees; 32% work for companies with fewer than 500 employees.

Compared with previous years, the Europe-based respondents reported more experience working in the bio/pharma industry; 26.8% had fewer than 10 years of experience, 30.8% had 10-20 years, 35.9% had 20-35 years of experience, and 6.4% have worked in the industry for more than 35 years. About half of the respondents worked outside the bio/pharma industry for up to five years.

More work, less play …

Workloads increased slightly in 2017, with 64.2% reporting increases compared with 56.6% in 2016. Almost one-third of the respondents (32.9%) say they worked more hours in 2017 than two years ago, similar to responses in previous years. While 47.3% of Europe-based respondents (56.3% for US respondents) said they were contracted to work approximately 40 hours per week, only 25.7% (21.6% for US) reported working 40 hours. More than 17% (31.4% for US respondents) said they were contracted for more than 40 hours per week; however, 52.7% of the respondents (more than 70% for US) said they work 40 or more hours per week.

Vacation and paid time off benefits were more generous in Europe; 87% of the European-based respondents reported four or more weeks of paid vacation, compared with 43.3% for US respondents. Of all respondents, 27.3% reported that they used their full allotment of vacation, personal, and sick time. A similar percentage (22.5%) said they used less than half of the available time off. European-based respondents (70%) were more likely to use at least three-quarters of their paid time off compared to US-based respondents (57.4%).

But more pay

Salaries were up globally; in Europe, 58.7% reported a salary increase in 2017, up from 48.7% in 2016. Satisfaction with salary levels improved compared to the past two years; however, more than half (54.7%) were dissatisfied with their compensation. Similar to the global audience responses, 40% of the respondents said they were paid at the low end of the salary range for their job function for their expertise and responsibility; 14.7% said they were paid below market value (

).

In for the long term?

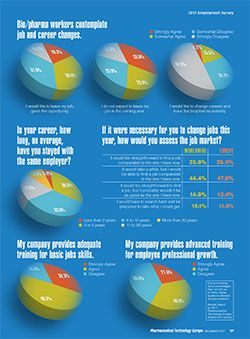

While three-quarters of the respondents have more than 10 years of experience in bio/pharma, 35% stayed with the same employer--on average--for less than five years compared with 24.9% for the global audience. More than one-third of the 2017 respondents said they stayed with an employer for an average of 6-10 years; 31.2% stayed with the same employer for more than 10 years (

).

In addition to salary and benefits, employee recognition can play a role in job satisfaction. Similar to the global audience responses, most Europe-based respondents said their work is fully valued by their employer (25.4% strongly agreed; 54.9% agreed). More than 80% of respondents said their skills and training are used to the fullest level. Only 52% see opportunity for career advancement in their current position; 62% reported opportunities for professional advancement at their current companies, slightly lower rates than reported by the US audience.

Career intangibles

Compared with responses from the global audience, Europe-based respondents express strong opinions about single factors that would motivate them to change jobs; professional advancement (38.8%), work/life balance (37.3%), and intellectual challenge (31.3%) were the top factors.

Similarly, the respondents from Europe were more likely to define single factors as “the main reason I come to work;” intellectual stimulation (40.3%), challenging projects (35.8%), and relationships with colleagues (30%) were the top reasons cited.

Overall, respondents were tolerant of negative workplace activity; only a small fraction cited factors that would cause them to quit their jobs; issues with management (19.4%), work/life balance (14.9%), a long commute (12.1%), and discrimination (11.9%) were most frequently cited.

Seeking better employment opportunities

More than half of the 2017 respondents (54.9%) “agreed somewhat” or “agreed strongly” that they would “like to leave their job, given the opportunity,” up slightly from 2016. More than one-third said they were “likely to leave my job voluntarily in the coming year;” only 9.9% expected to leave their job involuntarily. In a somewhat concerning result, nearly 20% said they would like to change careers and leave the bio/pharma industry (

).

While the desire to change positions is strong, the number of people actually changing jobs is significantly less, but growing. In 2016, 17.1% of respondents reported a voluntary job change; in 2017, that number jumped to 28.2%.

Confidence levels of those seeking new bio/pharma positions continued to rise in 2017; 26.9% said it would be straightforward to find a comparable new job; 47.8% said it may take a while, but they would be able to find a comparable position. The percentage of less-optimistic job seekers declined slightly, 13.4% said it would be straightforward to find a job, but the new job probably would not be as good as the current position; 11.9% anticipated a difficult search and they would have taken whatever position was available (

).

References

1. 2017 Pharmaceutical Technology/Pharmaceutical Technology Europe Employment Survey, Pharmaceutical Technology, 2017.

2. 2016 Pharmaceutical Technology/Pharmaceutical Technology Europe Employment Survey, Pharmaceutical Technology, 2016.

Article Details

Pharmaceutical Technology Europe

Vol. 29, No. 12

December 2017

Page: 14–18

Citation

When referring to this article, please cite it as R. Peters, “What are the Ingredients for Bio/Pharma Career Advancement?" Pharmaceutical Technology Europe 29 (12) 2017.

Articles in this issue

about 8 years ago

Disputes Over Manufacturing Waiver and Other SPC Exemptionsabout 8 years ago

Opportunities with Softgelsabout 8 years ago

What’s in Your SOP?about 8 years ago

Transformative Medicines Challenge FDA and Manufacturersabout 8 years ago

Pharma Outsourcing: A Year in Reviewabout 8 years ago

Outsourcing: A Year in Reviewabout 8 years ago

Designing Sustainable Pharma Facilitiesabout 8 years ago

Evaluating Surface Cleanliness Using a Risk-Based Approachabout 8 years ago

Formulating a Recipe for Bio/Pharma Career SuccessNewsletter

Get the essential updates shaping the future of pharma manufacturing and compliance—subscribe today to Pharmaceutical Technology and never miss a breakthrough.