PTSM: Pharmaceutical Technology Sourcing and Management

- PTSM: Pharmaceutical Technology Sourcing and Management-12-04-2013

- Volume 9

- Issue 12

Pharma's Year in Review

Pharmaceutical Technology takes a look at the major deals and moves of 2013.

Looking at the first 11 months of 2013, mergers and acquisitions (M&A) in the pharmaceutical/biopharmaceutical industry have increased on both a value and volume basis compared to the same period last year. Although there were no megamergers in the industry, there were several noteworthy deals.

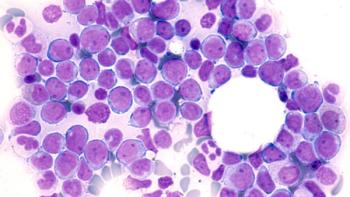

Thus far in 2013, there have been several noteworthy transactions. Amgen’s $10.4-billion acquisition of the biopharmaceutical company Onyx Pharmaceuticals, is one of the largest therapeutics transactions of the year. In August 2013, seeking to build its oncology drug portfolio, Amgen agreed to acquire the biopharmaceutical Onyx Pharmaceuticals for $10.4 billion ($9.7 billion net of estimated Onxy cash) and closed on the deal in October 2013. Onyx Pharmaceuticals has a growing multiple myeloma franchise, which includes Kyprolis (carfilzomib) for injection already approved in the United States. Onyx holds global rights to Kyprolis, excluding Japan. Kyprolis has orphan-drug designation in the United States with exclusivity until July 2019, and patents in the US that extend until at least 2025. In addition, Onyx has three partnered oncology assets: Nexavar (sorafenib) tablets (an Onyx and Bayer HealthCare Pharmaceuticals compound), an oral kinase inhibitor, approved in the US for unresectable hepatocellular carcinoma and advanced renal cell carcinoma; Stivarga (regorafenib) tablets (a Bayer compound), an oral kinase inhibitor, approved in the US for for metastatic colorectal cancer; and palbociclib (a Pfizer compound), an oral, small-molecule cyclin-dependent kinase 4/6 inhibitor, now in Phase III trials, to treat ER+, HER2-negative advanced breast cancer. Amgen says that the acquisition of Onyx will add to Amgen's late-stage pipeline. This pipeline includes nine innovative products for which registration-enabling data are anticipated by 2016. Four of these products are oncology products. Onyx's pipeline complements Amgen's oncology portfolio, according to Amgen.

Also, in August 2013, Amgen closed on its deal with the French pharmaceutical company Servier under which Amgen has obtained commercial rights in the US to Servier's oral drug, approved in the European Union as Procoralan (ivabradine), for chronic heart failure and stable angina in patients with elevated heart rates. Amgen also received an exclusive option to develop and commercialize Servier's investigational molecule, S38844, for cardiovascular diseases in the US. Currently, S38844 is in Phase II studies for the treatment of heart failure. Through the collaboration, Servier obtained an exclusive option to commercialize omecamtiv mecarbil in Europe. Omecamtiv mecarbil is an activator of cardiac myosin, which is currently being tested for potential applications in the treatment of heart failure in patients with systolic dysfunction.

Thus far, AstraZeneca has been active on the M&A front. In August 2013, MedImmune, the company’s biologics arm, agreed to acquire the biopharmaceutical company Amplimmune for $500 million with $225 million upfront and the rest contingent on the achievement of specified milestones. It closed on the deal in October 2013. Amplimmune is a Maryland-based developer of cancer immunotherapeutics.

The acquisitions strengthen MedImmune’s oncology pipeline by obtaining multiple early-stage assets for its immune-mediated cancer therapy (IMT-C) portfolio, including AMP-514, an antiprogrammed cell death 1 monoclonal antibody (mAb). AMP-514 is in late-stage preclinical development, and Amplimmune expects to file an investigational new drug filing before the end of 2013. Other Amplimmune assets include multiple preclinical molecules targeting the B7 pathways.

Founded in 2007 and headquartered in Gaithersburg, Marlyand, Amplimmune is focused on developing costimulatory/co-inhibitory molecules that rebalance the immune system and are intended for treating cancer, autoimmune disease, infectious disease, and transplantation. Amplimmune has three biologic product candidates: AMP-224 is in Phase Ib trials in cancer; AMP-110 for autoimmune diseases in partnership with Daiichi Sankyo; and AMP-514 for cancer. The acquisition builds on MedImmune's oncology R&D activities. MedImmune’s oncology research is focused on IMT-C, a therapeutic approach that may lead to durable and prolonged response rates across a range of cancer types. IMT-Cs are being designed for the immune system to counteract the tactics employed by cancer cells to avoid detection and attack the body. MedImmune's clinical-stage program includes tremelimumab, an anti-OX40 mAb, and MEDI-4736, an anti-PD-L1 mAb. The acquisition of the Amplimmune technology and pipeline strengthens AstraZeneca's and MedImmune portfolio to enable the use of data-driven combinations of IMT-C molecules as well as combinations with highly targeted small molecules.

In another deal, in June 2013, AstraZeneca completed its $1.2-billion acquisition of Pearl Therapeutics, which is focused on the development of inhaled small-molecule therapeutics for respiratory disease. The acquisition gives AstraZeneca access to a potential new treatment for chronic obstructive pulmonary disease currently in late-stage development and inhaler and formulation technology that provides a platform for future combination products. The $1.2-billion deal included $560 million in upfront payments, $450 million in deferred compensation contingent on reaching certain development and regulatory milestones, and $140 million in sales payments, contingent on reaching sales thresholds.

In May 2013, AstraZeneca agreed to acquire Omthera Pharmaceuticals, a specialty pharmaceutical company based in Princeton, New Jersey, focused on the development and commercialization of new therapies for abnormal levels of lipids in the blood for $323 million ($260 million in cash and $63 million for Omthera’s cash balance). Omthera’s investigational product, Epanova, being developed for the treatment of patients with very high triglycerides, is a omega-3 free fatty acid composition that has been shown to bolster levels of eicosapentaenoic acid and docosahexaenoic acid in the blood. In addition to the cash payment, each Omthera shareholder will receive contingent value rights of up to approximately $4.70 per share, equating to approximately $120 million in total, if specified milestones related to Epanova are achieved, or if a milestone related to global net sales is achieved. This will bring the total potential acquisition cost to approximately $443 million. The transaction is expected to close in the third quarter of 2013. Also in April 2013, MedImmune, the biologics arm of AstraZeneca, acquired AlphaCore Pharma, an Ann Arbor, Michigan-based biotechnology company focused on the development of ACP-501, a recombinant human lecithin-cholesterol acyltransferase (LCAT) enzyme.

Other deals

In a move to bolster its oncology portfolio, Johnson & Johnson completed its $1-billion acquisition of Aragon Pharmaceuticals, a privately held pharmaceutical discovery and development company focused on drugs to treat hormonally driven cancers. The acquisition includes Aragon’s androgen receptor antagonist program. Aragon’s lead product candidate is a second-generation androgen receptor signaling inhibitor, ARN-509, in Phase III development for castration-resistant prostate cancer (CRPC). Under the terms of the agreement, Johnson & Johnson is making an upfront cash payment of $650 million, plus additional contingent payments of up to $350 million based on reaching predetermined milestones.

In May 2013, GlaxoSmithKline acquired Okairos, a Swiss privately held developer of vaccine platform technologies for EUR 250 million ($325 million) in cash. GSK plans to use the vaccine platform in its of new prophylactic vaccines (designed to prevent infection) as well as new classes of therapeutic vaccines (designed to treat infection or disease). The deal also includes a small number of early-stage assets.

Other deals include: Perrigo's proposed $8.6-billion acquisition of Elan; Shire's proposed $4.2-billion acquisition of Viro Pharma, a company specializing in treatments for rare diseases; Valeant's $8.7-billion acquisition of Bausch + Lomb; and Actavis' $8.5-billion acquisition of Warner Chillcott.

Contract-service provider activity

Among contract service providers, two key moves were the merger of Cambridge Major Laboratories and AAIPharma Services and the proposed merger of Patheon with DSM Pharmaceutical Products.

Articles in this issue

about 12 years ago

Pharma News in Global Health and Sustainabilityabout 12 years ago

The Global Divide in Pharma Industry Growthabout 12 years ago

Disposable Applications in Demand for BioPharmaNewsletter

Get the essential updates shaping the future of pharma manufacturing and compliance—subscribe today to Pharmaceutical Technology and never miss a breakthrough.