But are innovations sufficient to increase adoption? CMOs are demanding better continuous bioprocessing options.

Eric Langer has over 25 years experience in biotechnology and life sciences strategic marketing management, market research, and publishing. He has held senior management and marketing positions at biopharmaceutical supply companies. He has published and authored many books and reports on topics in Biotechnology, Large-scale BioManufacturing, and bioscience commercialization and communication. He teaches at Johns Hopkins University marketing management, biotech marketing, services marketing, and marketing in a regulated environment. In 1989 he co-founded BioPlan Associates, Inc. to provide market analysis, and strategy to biotech and healthcare organizations.

But are innovations sufficient to increase adoption? CMOs are demanding better continuous bioprocessing options.

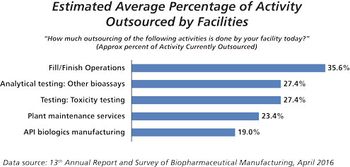

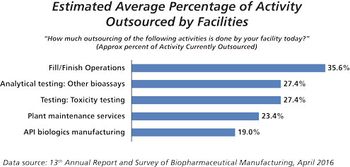

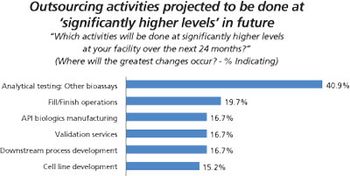

Outsourcing of manufacturing activities is expected to increase in 2019.

The growth in adoption of single-use systems for commercial manufacturing will be dramatic in coming years.

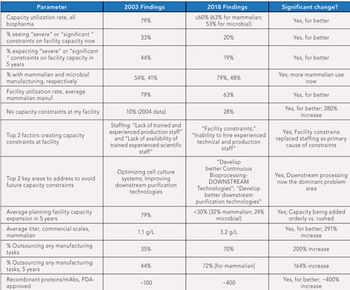

This article highlights 15 years of changes in biopharmaceutical manufacturing.

The biopharma industry is growing at 14-15%, but efficiency demands and lack of skilled labor may impact performance.

Innovation speeds discovery, drives down costs, and improves productivity.

Despite the benefits of continuous processing adoption has been slow, except for a few process areas.

Although widespread adoption of continuous bioprocessing has been slow, some processes have been an exception.

With a healthy supply of biosimilars heading to the approval pipeline, will license holders turn to contract manufacturers for development and production?

Biosimilars may be the key to CMO growth.

Automation, single-use systems, smaller footprints, and new drug delivery devices define trends for fill/finish outsourcing.

This key bioprocessing segment is expecting continued growth

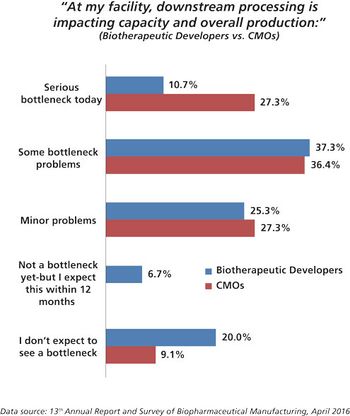

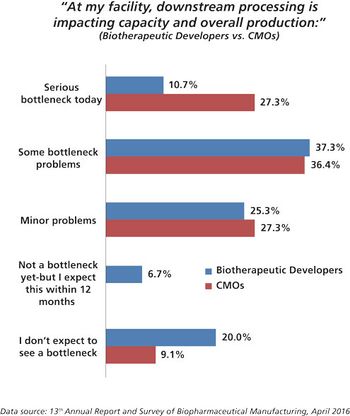

CMOs experiment with new filtration and purification methods to alleviate downstream bottlenecks and stay competitive.

CMOs are working hard to improve performance by investigating new technologies for filtration and purification.

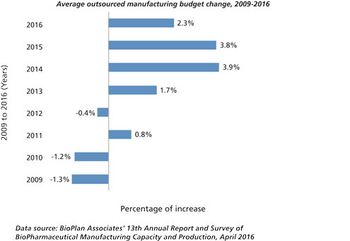

Outsourcing budgets continue to grow, but at a slower pace than observed in the past couple of years.

Growth may be slowing, but outsourcing activity remains healthy.

Better process development is creating industry benchmarks for bioprocessing.

Better process development is creating industry benchmarks for bioprocessing.

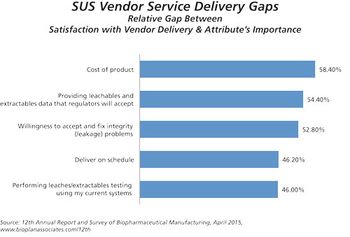

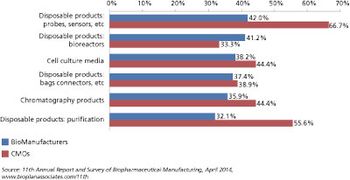

The high cost of disposables is a factor in restricting adoption of single-use devices.

Suppliers indicate prices for single-use equipment are likely to increase.

Biopharma companies are outsourcing more jobs to cut costs.

More contract service options encourage biopharma companies to cut costs by cutting jobs.

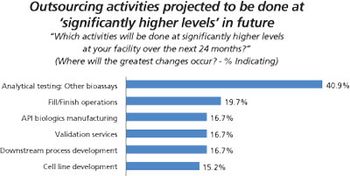

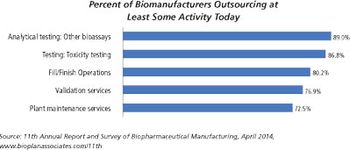

More biopharma companies choose outside service providers for assay testing.

Biopharma companies on both sides of the Atlantic ship more of their assay testing to outside service providers.

While biomanufacturing clusters continue to emerge outside of North America and Western Europe, they are unlikely to threaten these powerhouse CMOs.

While the United States and Europe still dominate, CMOs and CROs based in emerging markets continue to capture market share.

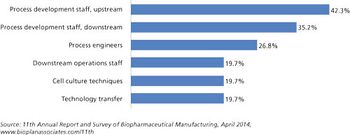

Capacity expansions require staff expansions, and skilled, experienced staff, at all levels, are simply becoming increasingly hard to find.

Is there enough talent to go around?

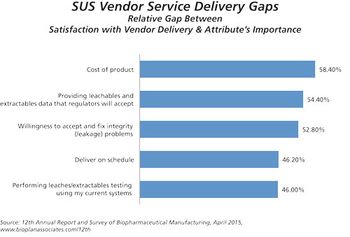

Biomanufacturers are seeking more innovation and expertise from their CMO partners.

In-house biologics fill/finish operations have invested in new technologies and have available capacity while small-molecule fill-finish facilities work at near-capacity on legacy equipment.

Published: February 6th 2013 | Updated:

Published: February 1st 2013 | Updated:

Published: February 28th 2014 | Updated:

Published: February 28th 2014 | Updated:

Published: April 2nd 2014 | Updated:

Published: February 2nd 2014 | Updated: