Heightened uncertainty means CDMO executives need to play out planning scenarios.

Jim Miller is president of PharmSource Information Services, Inc., and publisher of Bio/Pharmaceutical Outsourcing Report.

Heightened uncertainty means CDMO executives need to play out planning scenarios.

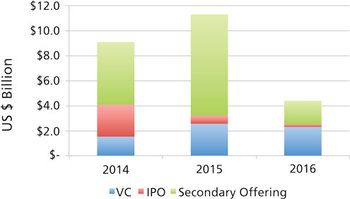

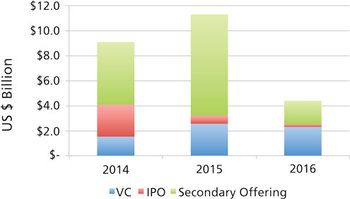

CDMOs can claim credit for the robust growth of emerging bio/pharma financings.

The industry will see an impact from financing, M&As, advanced therapies, generic drugs, and the retail market in 2018.

Recent acquisitions are creating CDMOs with scale that rivals global bio/pharma.

Acquisition activity has created some CDMOs with facilities and capabilities that rivals global bio/pharma companies.

Investors are betting on the current growth of CDMOs; but history reminds us that extrapolating today’s market well into the future is dangerous.

Mergers and acquisitions are positive for the CDMO industry, but there is a downside.

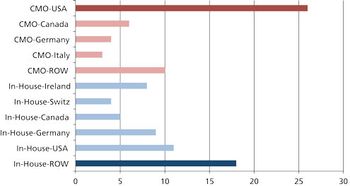

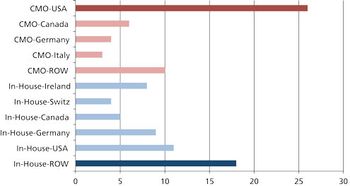

Matching the production requirements of a bio/pharma company with the manufacturing capabilities of a CMO is a delicate balance, requiring attitude shifts on both sides of the table.

CMOs must embrace flexibility in their technology decisions and business arrangements.

How has the bio/pharmaceutical contract manufacturing industry evolved over the years and what does the future hold?

CMOs may be gaining as strategic partners to large bio/pharma companies, but compared to CROs, they face a tougher climb to capture a larger segment of the pharma manufacturing market.

CMOs may be gaining as strategic partners to large bio/pharma companies, but they have a much harder path to navigate.

What are the pros, cons, and practicalities of moving pharma manufacturing back to the US? \

Moving global manufacturing operations may be more complicated than it appears.

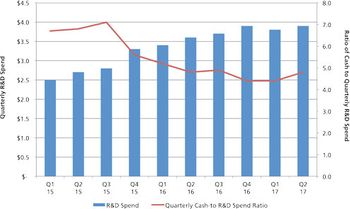

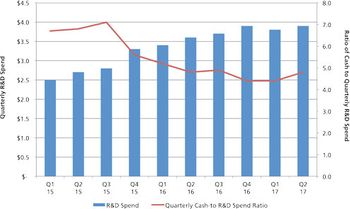

Rising R&D numbers and positive external funding for bio/pharma projects a strong outlook for the contract development and manufacturing market in 2017.

Robust venture capital investment gives CDMOs and CROs a positive outlook for 2017.

M&A activity, new business models, fundraising limits, offerings from small CDMOs, and combination products are driving decisions in the contract services market..

CMO executives are focusing on M&A activity, new business models, and fundraising limits.

CMOs chose innovation vs. capacity paths to compete in the pharma market.

The strategies of a innovation-driven CMO may be different than a capacity-driven CMO.

Unfavorable public investment markets could put emerging bio/pharma growth and CDMO spending at risk in 2017

CMOs that offer an innovative service-oriented model will dominate the industry.

Bio/pharma companies that are qualifying potential contract service providers should investigate post-merger integration activities and capital structure as part of the due diligence.

CDMOs need to be aware that unfavorable public markets put emerging bio/pharma R&D spending at risk in 2017.

Acquisition binges often lead to hangovers; here’s what to watch out for.

Booming market demand is driving early development services for formulation development and manufacturing of early-phase clinical trial materials.

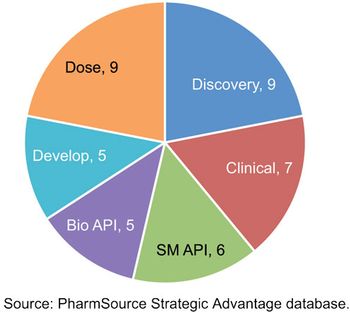

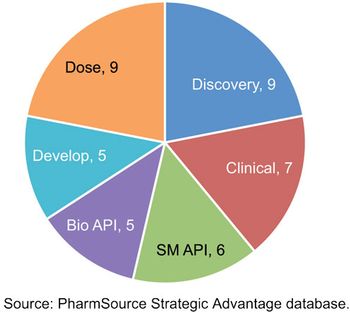

Demand is driving expansion and consolidation of formulation and clinical trial materials services.

Global economic and political uncertainty could slow bio/pharma development activity.

Heightened global uncertainty could slow bio/pharma development activity.Bio/pharmaceutical companies, and the companies that serve them, tend to think they are immune from broader macroeconomic and political developments. As populations age, emerging middle classes expand, and scientific knowledge progresses, research on new drugs and demand for new therapies seem to follow an inexorably upward trend.

As CMOs consolidate to gain a competitive edge, fewer acquisition targets may slow buying pace.

Published: February 2nd 2013 | Updated:

Published: January 9th 2013 | Updated:

Published: February 1st 2013 | Updated:

Published: October 2nd 2001 | Updated:

Published: September 2nd 2001 | Updated:

Published: March 1st 2002 | Updated: