CMO industry consolidation may be frustrated by a dearth of attractive assets.

Jim Miller is president of PharmSource Information Services, Inc., and publisher of Bio/Pharmaceutical Outsourcing Report.

CMO industry consolidation may be frustrated by a dearth of attractive assets.

While biologics development grabs investor interest, small-molecule APIs still hold two-thirds of the drug-development pipeline.

Despite emergence of biologics, small-molecule APIs benefit from industry growth.

Memories of tough economic times may discourage CDMOs from expanding capacity.

What if the expanding pipeline isn’t enough to fuel CMO growth?

While all market signs are pointing up, memories of past setbacks may discourage from expanding capacity.

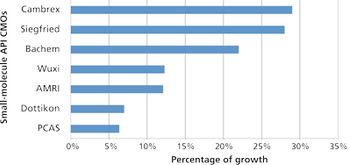

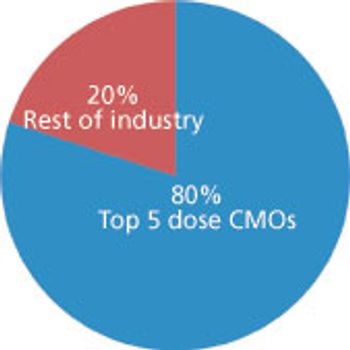

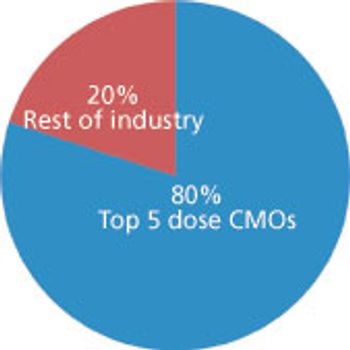

Big service providers get bigger faster thanks to Big Pharma.

Big service providers get bigger faster thanks to Big Pharma.

Biosimilars may add a nice increment to the pipeline opportunities, for CMOs, but they are unlikely to be a bonanza for the industry.

Market forces may limit the success of CMOs.

European CDMOs want into the US market, but limited options leave them on the outside, looking in.

As the number of CMOs shrinks due to acquisitions, exits, compliance problems and a switch to proprietary products, the capacity available to industry is reduced.

European CDMOs want into the US market, but entry options are limited.

The trend of exits from the CMO industry looks to be gaining momentum.

The contract services industry?s success is largely a result of the improved financial environment, rather than an increased acceptance of outsourcing.

More health systems are saying ?no? to reimbursements for new drugs; CMOs must adjust strategies.

Contract services ride high as funding floods bio/pharma.

As payers refuse to cover new drugs, CMOs take a hit.

Why can't the CMO industry break through to manufacture a greater share of drugs?

The CMO industry's value proposition is limiting its market penetration.

Changes in company ownership shake up the CMO industry.

Changes in company ownership shake up the CMO industry.

The R&D model is in transition and creating new demands on contract services providers.

Ongoing changes create new opportunities for CROs and CMOs.

The R&D model is in transition and creating new demands on contract services providers.

Ongoing changes create new opportunities for CROs and CMOs.

Practicality of implementation should be a part of vision in the bio/pharmaceutical industry.

Practicality of implementation should be a part of vision in the bio/pharmaceutical industry.

Are strategic partnerships in clinical research a model for CMC services?

Are strategic partnerships in clinical research a model for CMC services?