Asian countries are moving up the value chain for pharmaceutical outsourcing.

2009 will likely be a difficult period for emerging biopharmaceutical companies.

When accusations fly: 'Tis better to give than to receive.

The past year saw major acquisitions attempted, completed, rejected, and stalled.

Readers provide insight into the best companies to work for as well as the ups and downs of their jobs.

While the world pulls itself out from one of the worst crises in decades, Indian pharmaceutical companies are trying to capitalize on falling company prices by increasing their takeovers.

China's quality approach to domestic versus exported products seems to be a lose-lose situation.

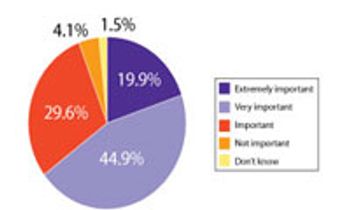

A recent Pharmaceutical Technology survey examined the level, sources, and reasons behind innovation in drug development and manufacturing. This article contains bonus online-exclusive material.

A book about pharmaceutical analysis engages the reader with history and unexpected asides.

The next president and the 111th Congress might change the extent of FDA's authority.

Also, Johnson & Johnson will acquire Omrix Biopharmaceuticals for $438 million; Charles River Laboratories promoted Foster Jordan to corporate senior VP of endotoxin and microbial detection products; more...

Companies at the American Association of Pharmaceutical Scieintists (AAPS) unveiled technologies, expansion plans, and services for formulation development, manufacturing, and drug delivery at the AAPS Annual Meeting and Exposition held in Atlanta last week.

The American Association of Pharmaceutical Scientists (AAPS) recognized researchers in the pharmaceutical sciences at AAPS Annual Meeting and Exposition in Atlanta last week.

During its roundtable discussion titled "Follow-On Biologic (FOB) Drugs: Framework for Competition and Continued Innovation," The Federal Trade Commission (FTC) discussed likely effects, patent issues, and regulatory exclusivity periods concerning FOBs.

The US Food and Drug Administration issued a draft guidance, Contents of a Complete Submission for the Evaluation of Proprietary Names, on Nov. 24, 2008.

In a letter to Acting Comptroller General Gene Dodaro dated November 19, 2008, Congressman Joe Barton (R-Texas) requested that the US Government Accountability Office (GAO) review the US Food and Drug Administration's handling of the highly-publicized, tainted heparin scare that occurred in 2007 and 2008.

Ranbaxy Laboratories (Gurgaon, Haryana, India) responded to an investigation of violations at two of its manufacturing plants, according to a Reuters Health report.

Although the number of annual new-drug approvals in the United States has steadily declined during the past ten years, pharmaceutical companies still prefer to introduce new products in the US first, according to a report published by the Tufts Center for the Study of Drug Development.

The US Food and Drug issued a draft guidance on Tuesday, Nov. 18, titled Process Validation: General Principles and Practices for comment. The guidance is meant to serve as a revision to the 1987 Guideline on General Principles of Process Validation.

The US Food and Drug Administration issued a direct final rule last week to adjust for inflation the maximum civil money penalty amounts for various civil money penalty authorities under the agency's jurisdiction.

Also, BASi opens European office in Warwickshire, UK; Acusphere's Howard Bernstein Resigns; More...

US marshals seized 11 lots of heparin from Celsus Laboratories (Cincinnati, OH) at the request of the US Food and Drug Administration.

Rep. John Dingell (D-MI) plans to introduce the Food and Drug Globalization Act discussion draft as a bill early next year.

Novo Nordisk will invest nearly $400 million to build a new insulin plant in Tianjin, China.

Also, Patheon opens new European headquarters, Cynvec appoints Frank D. Stonebanks president and CEO, more...

The Steering Committee and Expert Working Groups of the International Conference on Harmonization are meeting this week in Brussels to discuss current harmonization efforts.

PAT may reduce costs by helping companies control process variability, improve yields, reduce waste, and produce high-quality therapies consistently. Companies that have not yet embraced PAT may find its potential to reduce expenses a compelling argument in its favor during this time of financial difficulty.

PharmTech's monthly newsletter, Equipment & Processing Report, reviews the Editor's Picks for the November 2008 edition from ResistoPure and Millipore.

Until recently, automated inspection of solid-dose pharmaceuticals was crude, expensive, slow, and difficult to change over. But technological advances have ushered in a new class of vision-inspection systems that is more effective and more commercially viable than older systems.

The European Medicines Agency's (EMEA) Committee for Medicinal Products for Human Use recommended that the status of GlaxoSmithKline's anti-obesity drug "Alli" (orlistat) be switched from prescription-only to nonprescription.